Business

Finance Expert

Strategic Planning

Education

Financial Strategists

Who We Are

Our goal is to provide superior advisory services to businesses, corporate suppliers and banks to enhance their business performance. We help our clients by recognizing that each client situation is different and may require unique solutions. We firmly believe that knowledge is good business.

IT STARTS HERE

Why should you use our services?

Our goal is to provide superior advisory services to businesses, corporate suppliers and banks to enhance their business performance. We help our clients by recognizing that each client situation is different and may require unique solutions. We firmly believe that knowledge is good business.

Entrepreneurs

Emerging firms rarely have access to world class financial management advice from credible, reputable and vetted sources. We are that source. We assess your firm’s financial foundation. Assess its strengths, its weaknesses, its debt structure and provide quality solutions. We have access to qualified bankers, CPA’s and other financial advisors Our approach is consultative and practical based on years of experience in banking, finance, entrepreneurship and education. We help you become a stronger financial manager, which increases the value of your company

Banks

Your staff, client, prospects and some of your vendors will always need access to quality information to help them understand business financial management. Some of your staff may need an easy, cost effective and realistic way to assess the quality of prospects and obtain a firm but basic understanding of credit and risk management. Our services can help you accomplish these objectives in an efficient and cost-effective manner.

Organizations

Business organizations such as chambers of commerce, economic development entities and community groups that focus on business and community development will always need a way to engage financial institutions, learn about how capital and credit work. Our products and services allow you to do so in educational, convenient and effective way without esoteric language and we eliminate the mystery about how capital works.

Capital Quest

The ability to strategically grow your business is important to its survival. In order to grow, you need capital. Financial institutions want to lend money to firms that demonstrate an ability to repay debt. Securing credit is one of the strongest indications of a firm’s financial strength. Other than technology and legal considerations, the rules for borrowing and lending have not dramatically changed.

It’s as easy as 1-2-3.

The Financial Game

Final Four

Five Minute Financial

Financial Analysis

Financial Proposal

You are in good hands.

What To Expect

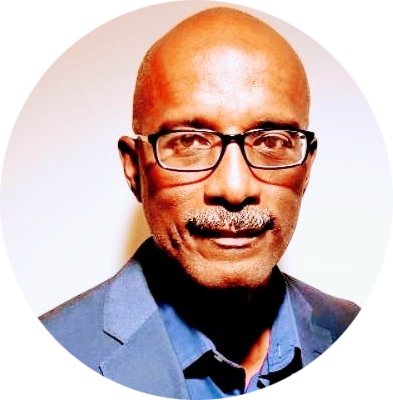

Historically, not everyone had access to capital. This is also true today. Some social inequities are a direct consequence of this fact. Therefore, it’s critical that we share knowledge in a way that enhances chances for success. During my twenty-year career in banking and finance, I witnessed firsthand the mistakes that many business owners typically make when seeking capital and managing their company’s finances.

This is a primer that I created to help business owners, bankers, educators, accountants, and financial consultants gain a fundamental understanding of finance and banking. My objective is to take the mystery out of lending and to educate about the pitfalls that often derail business owners in their quest for financing.

This primer is written in an easy-to-read style, with clear and concise examples and illustrations of typical business scenarios.

Testimonials

Financing Game

The rules for financing the growth of a business are clear, specific, and aside from certain legal and regulatory considerations, have remained the same for generations.

Trade Secrets

Confessions of an Ex-Banker

(How to Really Get the Money)

Please note that this document is a primer and a more comprehensive version of it is available to you if you take out a membership.

Send download link to:

PBS, We The Economy, https://www.wetheeconomy.com/